You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Moody’s Downgrades China’s Credit Outlook Amid Rising Debt and Economic Challenges

In a significant development, Moody’s, a renowned credit ratings agency, recently downgraded China’s credit rating outlook from “stable” to “negative.” This decision reflects the growing risks associated with escalating debt levels and a structurally slower economic growth trajectory in the nation.

Understanding Moody’s Decision

Moody’s decision to revise China’s credit rating outlook is grounded in multiple factors. Firstly, the surge in government spending to support distressed local governments and state-owned enterprises has led to heightened fiscal pressures.

Secondly, the ongoing crisis in China’s property development sector, constituting a substantial 25% of the GDP, has added to the challenges. With major developers facing bankruptcy and home prices plummeting, there are concerns about potential spillover risks impacting the broader economy.

Factors Contributing to the Downgrade

Moody’s also highlights its anticipation of slower potential growth for China in the coming years, projecting it to be around 3.5% by 2030. This projection is influenced by demographic trends and the imperative shift from an investment-led to a consumer-driven growth model.

The credit rating agency emphasizes that these factors collectively contribute to the downward revision in China’s credit outlook.

China’s Response

In response to Moody’s decision, China’s Finance Ministry expressed disappointment, asserting that the macroeconomy is on a recovery path post-pandemic. The Ministry contends that Moody’s concerns regarding growth and fiscal issues are unwarranted.

Despite China recording a robust 4.9% GDP growth in Q3 2023, surpassing market consensus, challenges persist. Significant reforms may be necessary to bolster consumption, enhance productivity, and counterbalance the decline in the property sector.

China’s Market Impact

The repercussions of Moody’s decision are not confined to the financial assessments alone.

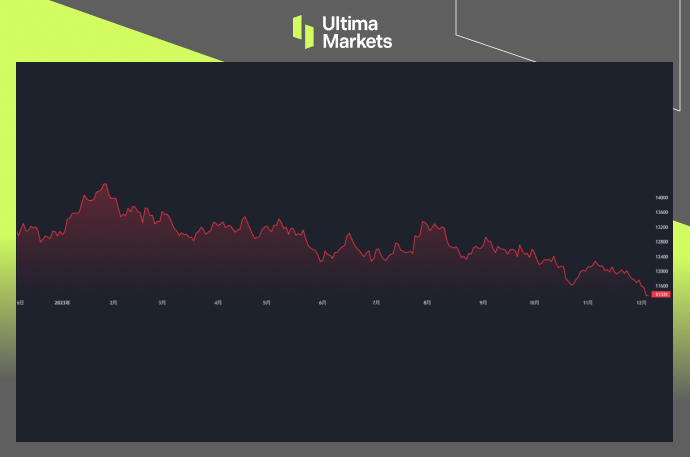

The FTSE A50, a market index monitoring the performance of the 50 largest A-share companies listed on the Shanghai and Shenzhen stock exchanges in China, experienced an extension of losses, reaching a year-to-date low subsequent to the report.

This underscores the tangible impact that credit rating adjustments can have on market indices and investor sentiment.

(FTSE A50 1-year Chart)

Frequently Asked Questions

Q1: What led to Moody’s decision to downgrade China’s credit outlook?

A1: Moody’s decision is primarily attributed to increased government spending, challenges in the property development sector, and anticipated slower economic growth.

Q2: How does China plan to address the concerns raised by Moody’s?

A2: China’s Finance Ministry has expressed disappointment with Moody’s decision and emphasizes the ongoing post-pandemic economic recovery. The nation remains committed to addressing challenges through necessary reforms.

Q3: What impact did Moody’s decision have on the FTSE A50 index?

A3: Following Moody’s report, the FTSE A50 index experienced extended losses, hitting a year-to-date low, indicating the market’s response to the revised credit outlook.

Bottom Line

In navigating these economic challenges, China faces the imperative task of implementing strategic reforms to restore confidence and stability. The evolution of the situation will be closely monitored by market participants and global economic observers.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.