You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

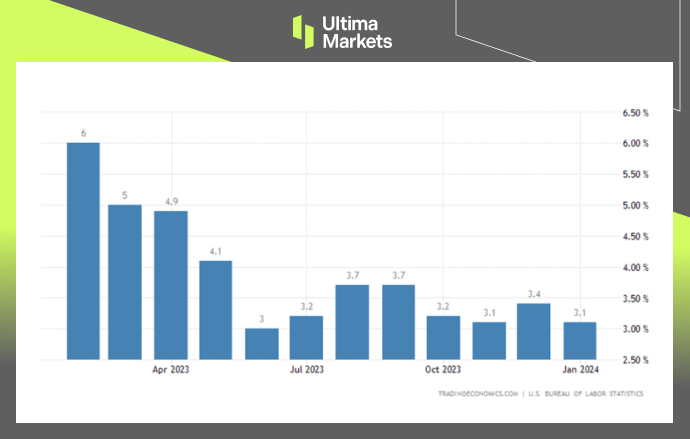

Equities declined across the board as US dollar hit three-month high following the release of US inflation data. According to Labour Department’s Bureau of Statistics, US Consumer Price Index (CPI) rose 0.3% last month, slightly higher than forecast of 0.2%. Looking at yearly comparison, US CPI currently stands at 3.1%, well above Federal Reserve’s target of 2%.

(US CPI Year-over Year Comparison)

Detailed in the report, US inflation continues to hover at high levels due to rising rental cost, which accounts for two-third of the increase. While food prices rose slightly last month, its effect was offset by falling energy prices in January.

The data came as Fed officials signalled that they are “in no hurry” to trim interest rates, with policy decisions to be made based on future economic data. Likewise, as the market is betting for a fall in CPI, with high bets for a rate cut in May. This has eventually led to deep selloff after its release, which also drags safe-haven assets downwards such as gold and Japanese Yen.

Looking at CME Group’s FedWatch Tool, the expectation for a rate cut in May slipped from 60.7% to 36.1%. In addition, US 10-year Treasury yield rose 14 basis points to 4.314%, its highest level since last December. As of writing, gold price was down 0.12% to $1990.71.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.