Japan GDP Contracts Sharply in Q1, BoJ Rate Hike Path in Doubt

TOPICSJapan’s economy shrank more than expected in the first quarter of 2025, raising fresh concerns about the sustainability of its economic recovery and casting doubt over the Bank of Japan’s planned path for monetary tightening.

Japan GDP Contract in Q1

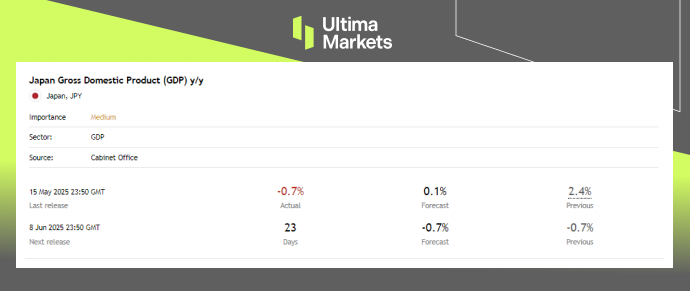

According to the latest preliminary GDP data release, the real GDP fell by an annualized 0.7% in Q1, far exceeding market expectation of 0.2% contraction. On the quarterly basis, the economy contracted by 0.2%, marking the first decline since last year, highlighting the country vulnerability to global trade headwinds.

Japan GDP y/y | Source: Japan Cabinet Office, Chart: Ultima Market Calendar

According to the Japan’s Government data release, the private consumption, which accounts for over half of Japan’s economy was flat. Meanwhile, exports dropped 0.6%, pressured by slowing global demand and rising uncertainty surrounding the US trade policy under President Trump, while rising in imports (+2.9%) added to the net trade drag.

Inflation Stay Elevated, Real Wages Lag

At the same time, Japan continues to battle with elevated inflation, with the Consumer Price Index (CPI) rising 4.2% annually in March. This persistent price pressure is eroding household purchasing power and undermining consumer confidence.

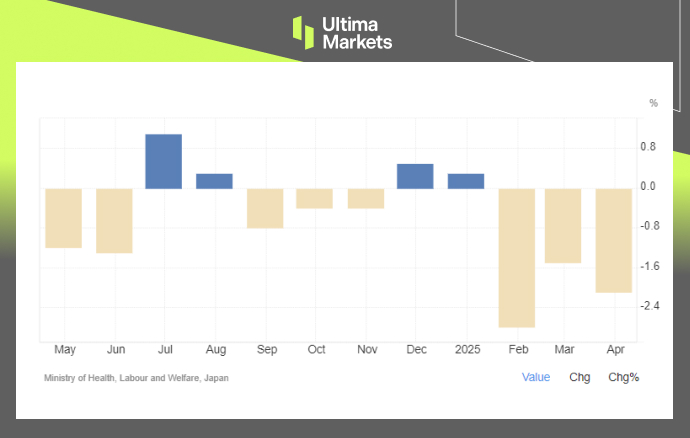

While this year’s spring wage negotiations delivered the highest nominal wage hike since 1991 — averaging 5.46%, the real wages—adjusted for inflation and key measure of consumer purchasing power— declined for the third consecutive month, falling 2.1% in April. The disconnect between nominal income gains and inflation-adjusted wages is preventing a broader consumer recovery.

Japan Real Wages (Inflation Adjusted) Growth | Source: Japan Ministry Office

Policy Implication: BoJ in Dilemma

The evolving wage-inflation dynamics are complicating the Bank of Japan’s policy path—especially as Japan’s economy showed signs of contraction in Q1, even before accounting for the potential impact of April’s tariff headwinds.

While BoJ officials have maintained a cautiously optimistic tone, citing continued wage and price growth, the slowdown in GDP and fragile consumer spending may force a more measured approach.

“If wage growth leads to sustained inflation, the BoJ may proceed with gradual rate hikes. However, the recent GDP contraction and continued weakness in real wages suggest a more complex challenge ahead,” said Ultima Markets Analyst Shawn.

Despite the uncertainty, the BoJ has reiterated its confidence in the underlying recovery trend, but also acknowledged that renewed trade headwinds could weigh on the outlook.

Outlook: More Clues to Determine

With the economy under pressure, expectations are growing that the government could introduce new fiscal stimulus measures to support growth. Prime Minister Ishiba’s administration may face mounting calls from lawmakers to cut taxes or expand public investment, particularly as the hit from tariffs becomes more visible.

Meanwhile, markets are watching upcoming wage and CPI data for April and May to gauge whether consumer spending can stabilize — a crucial factor in determining whether the BOJ will proceed with another rate hike by September or a longer pause in the policy.

Outlook on Japanese Yen

Recent renewed optimism over global trade and the postponement of Bank of Japan (BoJ) rate hike expectations have led to renewed downward pressure on the Japanese Yen.

The USD/JPY pair has rebounded strongly from 140 to 148 over the past three weeks. Although it has encountered resistance near the 148.00 level, the downside for USD/JPY appears limited, as any Yen strength may be undermined by the current market landscape, including softer Japanese economic data and narrowing yield differentials.

USDJPY, 4-H Chart Analysis | Source: Ultima Markets MT5

With the Yen remaining vulnerable to shifting global risk sentiment and domestic uncertainty, market participants are likely to seek further clues from upcoming April and May economic data. In the near term, the Yen could remain volatile, with its upside against major pairs likely to be limited.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server