PRÓXIMO

- Todo

- Dividendo

- Actualizaciones de productos

- CFD Rollover

- Horario de trading

- Mantenimiento

28 March 2025

Ultima Markets – The trading sessions of holiday in April

| Holiday | Date | Adjustments (Product / Actions) | |

| Lebaran Holiday | 2025.04.01 | Market Closed | USDIDR, USDINR |

| Lebaran Holiday | 2025.04.02 | Market Closed | USDIDR |

| Lebaran Holiday | 2025.04.03 | Market Closed | USDIDR, USDTWD |

| Ching Ming Festival | 2025.04.04 | Market Closed | HK50, HK50ft, HKTECH, USDTWD, USDIDR |

| Lebaran Holiday | 2025.04.07 | Market Closed | USDIDR |

| Mahavir Jayanti | 2025.04.10 | Market Closed | USDINR |

| Mahavir Jayanti | 2025.04.14 | Market Closed | USDINR |

| Day Before Good Friday | 2025.04.17 | Early Closed 17:00 | SPI200 |

| Early Closed 23:00 | UK100, UK100ft, GER40, GER40ft, EU50, FRA40 |

||

| Good Friday | 2025.04.18 | Market Closed | Indices, Shares, Bonds, ETF, Metal, Commodities, USDBRL, USDCLP, USDCOP, USDINR, USDIDR, USDKRW |

| Easter | 2025.04.21 | Market Closed | UK100, UK100ft, GER40, GER40ft, EU50, FRA40, FRA40ft, ES35, HK50, HK50ft, SPI200, SA40, BVSPX, HKTECH, UKOUSD, UKOUSDft, USDBRL,EUB10Y, EUB5Y, EUB30Y,EUB2Y, LongGilt, EURIBOR3M |

| Late Open 14:30 | Cocoa, Coffee, Sugar | ||

| Easter | 2025.04.22 | Late Open 02:50 | SPI200 |

| Late Open 03:15 | EU50 | ||

| Late Open 04:00 | UK100, UK100ft | ||

| Late Open 09:00 | FRA40 | ||

| ANZAC Day | 2025.04.25 | Late Open 10:10 | SPI200 |

| Freedom Day | 2025.04.28 | Market Closed | SA40 |

| Labour Day | 2025.04.30 | Early Closed 23:00 | GER40, GER40ft, EU50, FRA40 |

| Labour Day | 2025.05.01 | Market Closed | GER40, GER40ft, EU50, FRA40, FRA40ft, HK50, HK50ft, HKTECH |

| Labour Day | 2025.05.02 | Late Open 03:15 | EU50 |

| Late Open 09:00 | FRA40 | ||

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

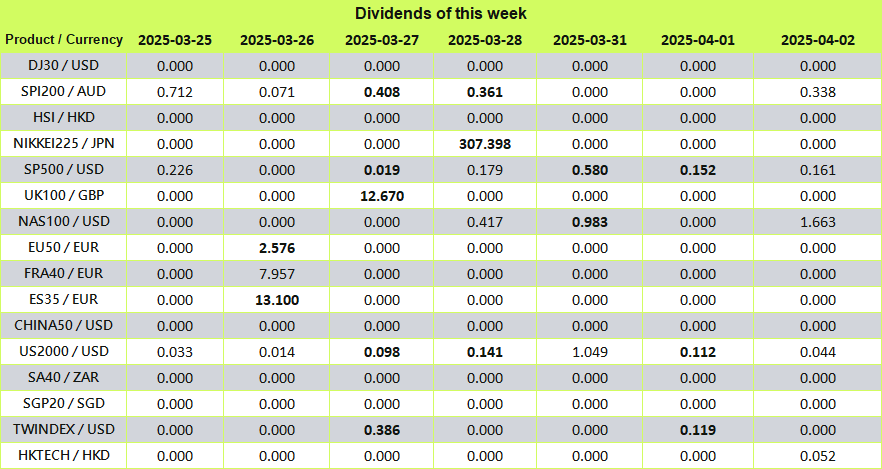

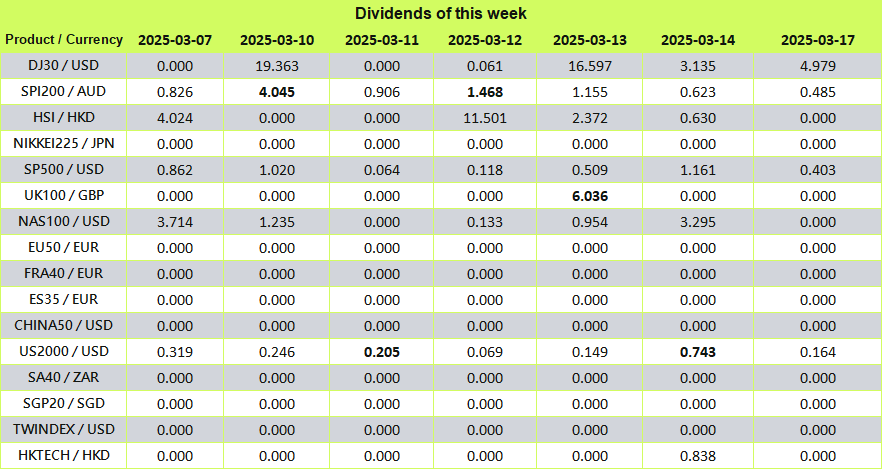

27 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

26 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

25 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

24 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

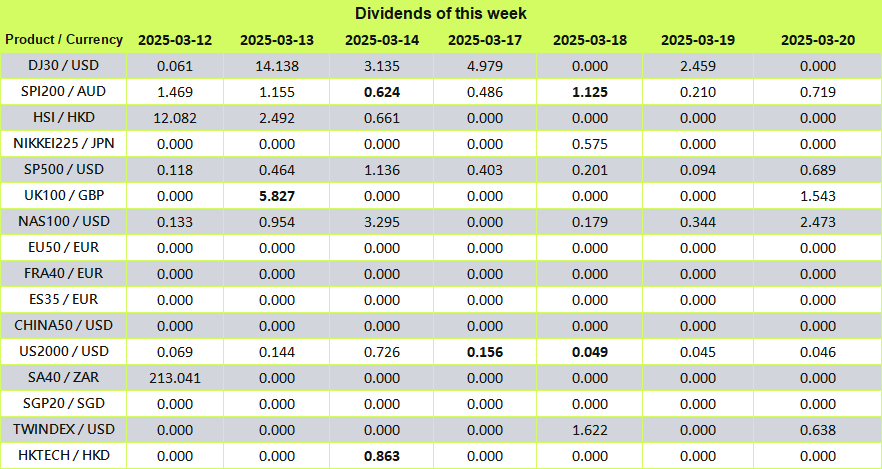

12 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

11 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

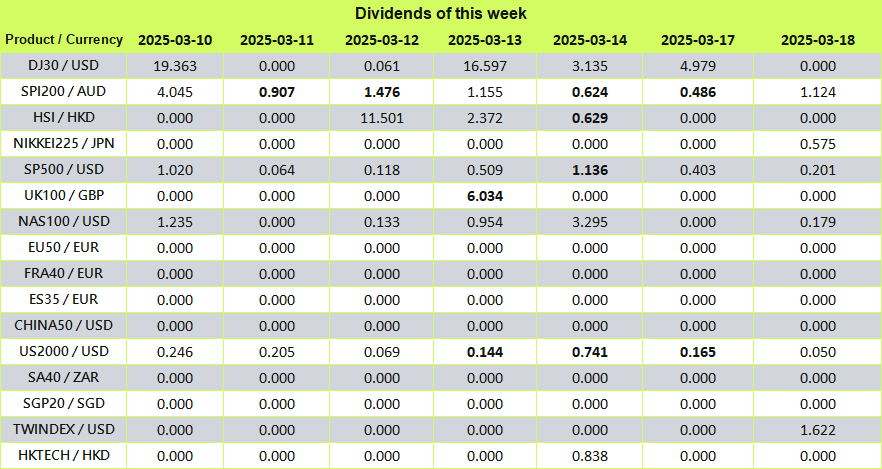

10 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

7 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

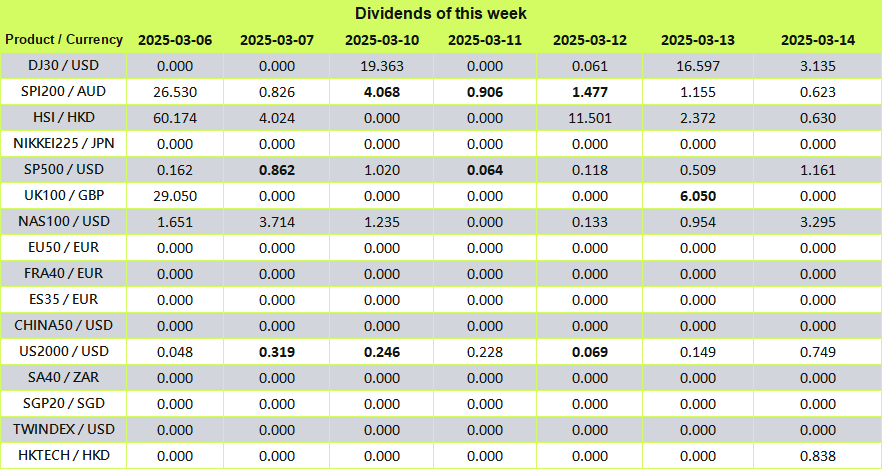

6 March 2025

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com